On tech antitrust, tech acting like government, the differing liberalism narratives, India’s inflation woes, and how cool is pre-modern metalworking?

Interesting Links: November 8, 2020

-

Ben Thompson wrote about the United States vs. Google lawsuit, which to be honest I never linked to because I didn’t find it particularly interesting & am personally bored of this narrative. But then Tim Wu wrote a post sub-titled ‘Smart, but a little too much Kool-Aid which admittedly has way more snark than is needed. To which Ben Thompson responded in his post is the internet different?, revelling in the snark that will lead him to even more eye-balls. And here we thought the newsletter media was going to be different from traditional media. But hey, I’m not complaining, anything is considerably better than most of mainstream media. And Tim Wu proceeded to respond here. And here we are, it worked, I’m now linking to all four pieces.

I don’t understand this even 1% as well as either of those two, but I’ll just leave this out there: if you owned the Silk Road, everyone appeared to think everything was ‘Chinese’ irrespective of where it came from. If you controlled the entire supply chain via the Silk Road, how do I show it’s better than the alternatives? What’s the counter-factual, if I just reshape the nature of reality?

Separately, on this idea of ‘zero marginal costs and zero distribution costs (but very significant fixed costs)’ for an Aggregator as defined by Thompson: I spent $1 billion to serve 100 million customers (high fixed costs!). Initially, I have 50 million customers - as I grow from 50 million to 100 million customers, woo hoo, zero marginal costs! I wish those same zero marginal cost companies would also pay their taxes accordingly rather than relying on fantastic depreciation modelling for their ‘significant fixed costs’ to show lower profits.

And oh, “Start with the transaction costs: while scaling an Internet service is a profoundly difficult thing to do, requiring tremendous ingenuity, invention, and investment, the marginal transaction costs for serving one additional customer are zero. That is why Google, from the moment it launched, could be used by anyone in the world.” Right, maybe Thompson had very different access to Google than what I had from roughly 1998 to 2002.

Oh, and “The same reality applies to Google’s marginal costs (including distribution); while Google spends a tremendous amount of fixed costs on its data centers and networking, any one search is “free”, including Google accepting the search term, computing the result, and delivering it to the user.” Clearly, Thompson has spent tons of time with DevOps and infrastructure maintainers. Just kidding!

And one more, “The relevant market here is not Gmail, it is email, and not only is there a huge amount of competition for hosted email, it is fairly simple to set up your own email server.” Right, clearly Thompson has actually tried running his own email server. It’s not difficult, but good luck trying to get other email hosting providers to recognize your email address as a valid one and not as spam. See above regarding controlling the Silk Road.

But in fairness to Thompson, one of his punchlines is definitely worth keeping in mind: “Google isn’t dominant because they broke the law, they are (arguably) breaking the law well after their dominance was established, and that distinction matters when it comes to crafting remedies and regulations that actually work.”

Of course, I don’t read Tim Wu as saying that either. As he notes: “The funny thing is, if you have what people want, you don’t usually pay for distribution: people pay you. The NFL doesn’t pay NBC to carry Sunday Night Football, and George Clooney does not pay to appear in movies. Knowing nothing else, you might then expect Apple to be paying Google if it has such an intrinsically superior product. That would follow if aggregation theory is 100% right about the quality of the user experience creating a true winner-take-all situation.”

And the corresponding Tim Wu punchline: “All this said, it may still be the fact that it is the quality of Google search, and not the extra goodies nor the money spent on defaults is what keeps people with Google…. But at core we have a contestable empirical question, not one answered by saying things about how transaction costs and marginal costs are zero.”

-

Byrne Hobart channels his naive anarchism-lite in Big Tech Sees Like a State. It’s an insightful read mainly to see how the world-view of folks in tech is taking shape. A sprinkling of economics, a sprinkling of philosophy, a sprinkling of theoretical political science, and you have yourself a legitimate sounding (data-driven!) world-view to help you sleep well at night. I’m not criticizing this - it’s something we all do. There is nothing particularly wrong with what the article is suggesting about seeing big tech like a government or a nation-state (as plenty have talked about for years). What’s interesting is tech folk patting themselves on the back & claiming to understand this article, while going back to their day jobs of doing you-know-what. You’re better off just reading the book review on Slate Star Codex. I mean, it, read that book review. It’s long but rewarding, especially if you haven’t already been exposed to those ideas in detail and with clarity.

-

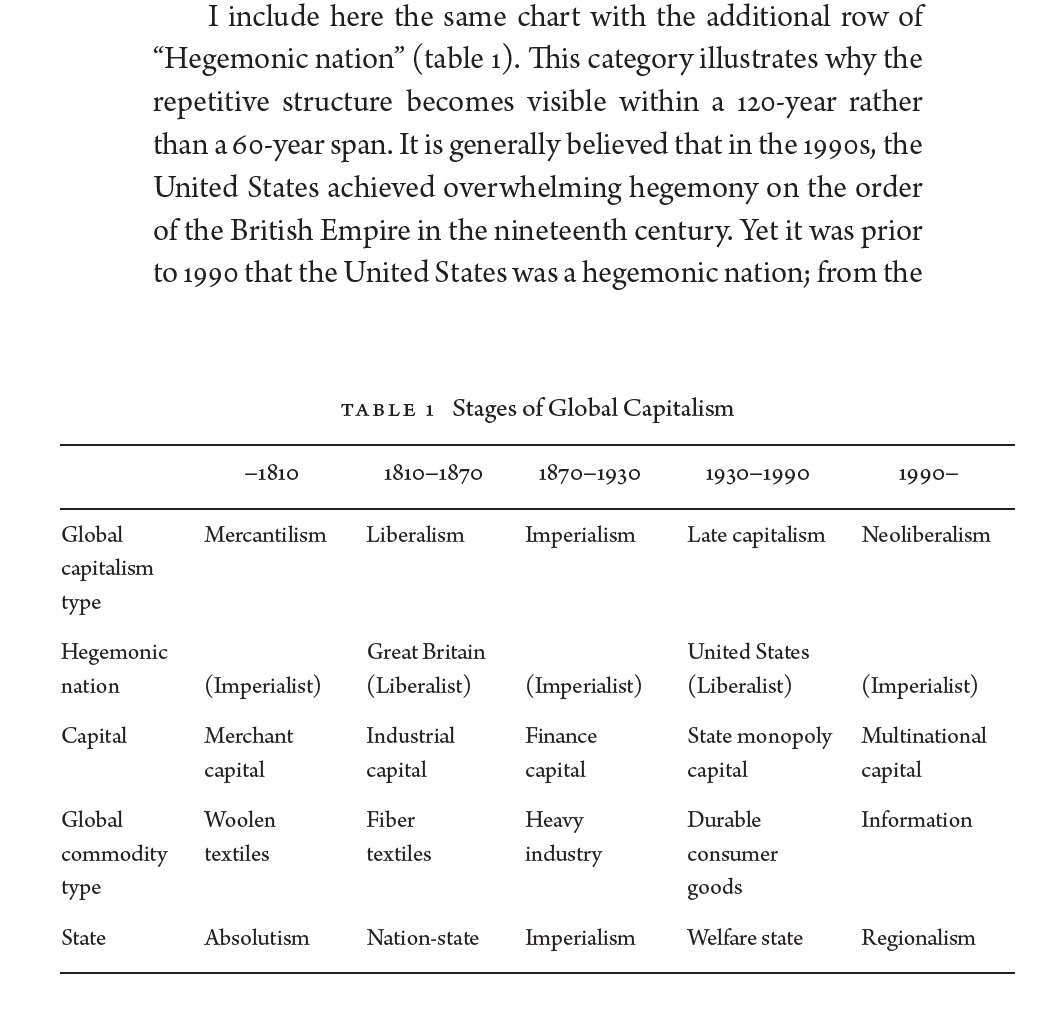

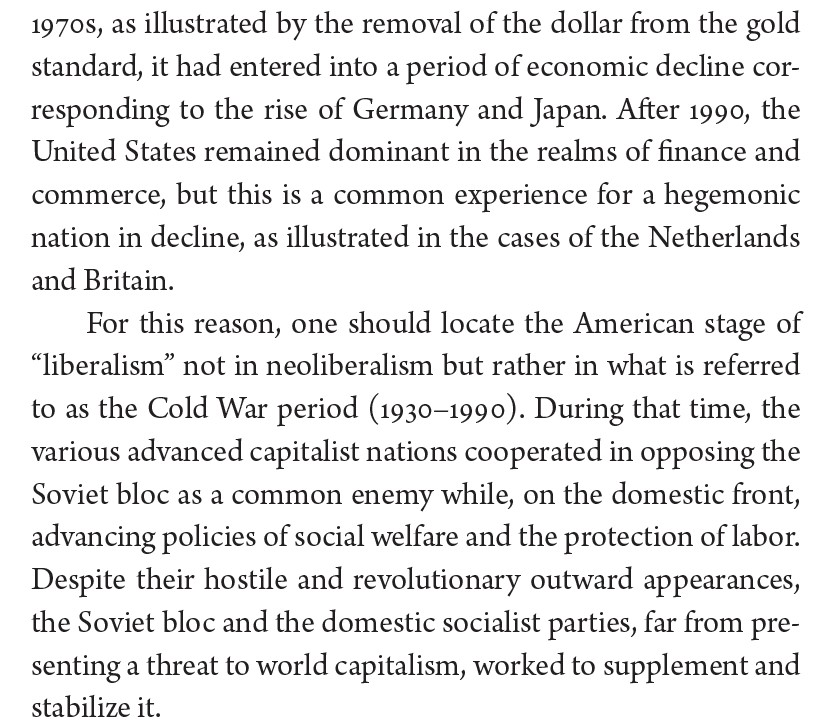

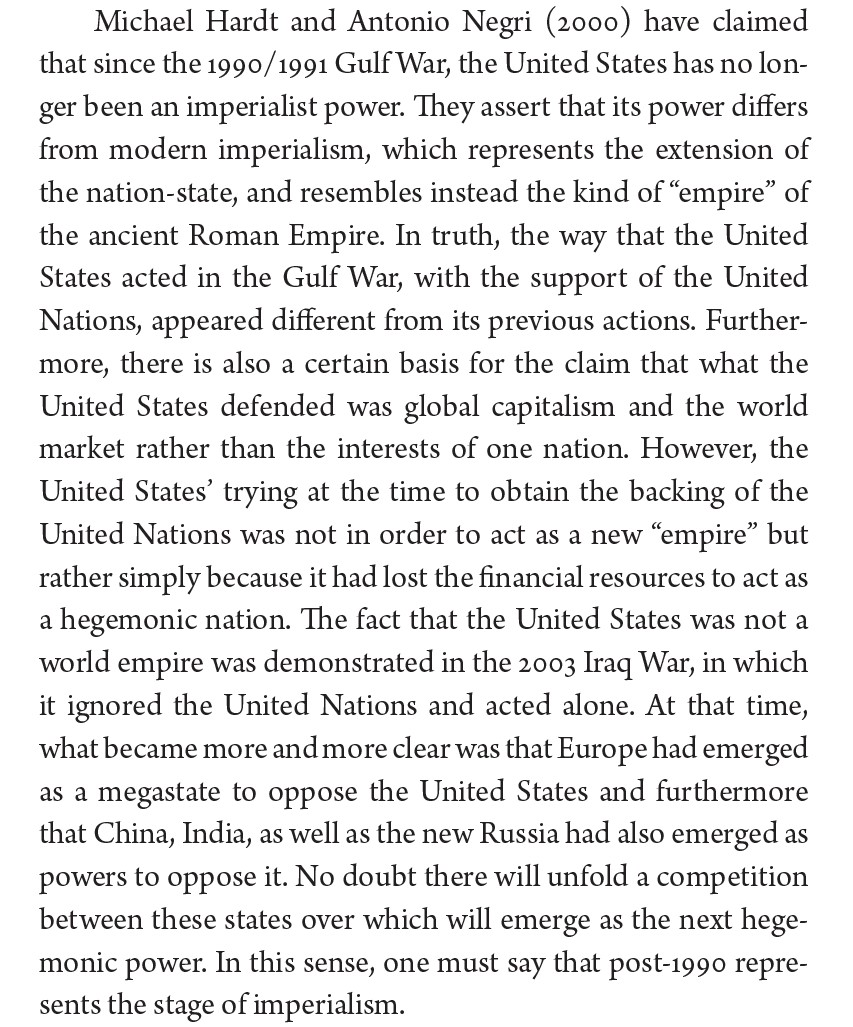

On the ChinaTalk blog, Ivan Krastev and Stephen Holmes talk about why liberalism didn’t work as well as expected post-1989. I don’t particularly agree with the narrative here, but I find the Western liberal narrative itself (as discussed in this post) fascinating. Similar to the comments about the US tech world above, the Western political science narrative is quite something. There are so many in-built assumptions in this narrative, but I just wanted to quickly focus on the fundamental premise. Here, the premise is that liberalism “won” with the end of the Cold War, and the question is whether or not the spread of liberalism post-Cold War worked as well as it should have. Contrast this to other (often Eastern) writers where the US and US liberalism has been in decline since the end of the Cold War (arguably the decline started in the 1970s) and for the past 30 years we’ve been in this period where nations are vying to become the new hegemony nation. An example of this is Kojin Karatani. See this excerpt from his History and Repetition for example.

-

Decent article on why is inflation still high in India?. And yes, ridiculous government taxes on fuel when oil prices have slumped worldwide is a non-trivial part of it.

-

Since the pandemic struck, money supply growth increased to 12.8% year on year in September, from 9.2% in March.

-

Growth in currency held with the public surged to 23.7% year on year in September from 14% in March. This indicates that more money is now chasing fewer goods and services — likely contributing to higher inflation.

-

International crude oil prices have slumped by about 38% since the start of the year. At the same time, domestic prices of diesel and gasoline have increased by around 6-8% because of the higher fuel taxes imposed in May. This has created a cost push-shock.

Similarly, wholesale and consumer prices have dramatically diverged.

-

-

Fascinating blog post on wootz steel in South India along with cast iron in China during the Iron Age. This whole blog is fantastic - along with the posts linked to in the above-post about pre-modern iron and steel production.